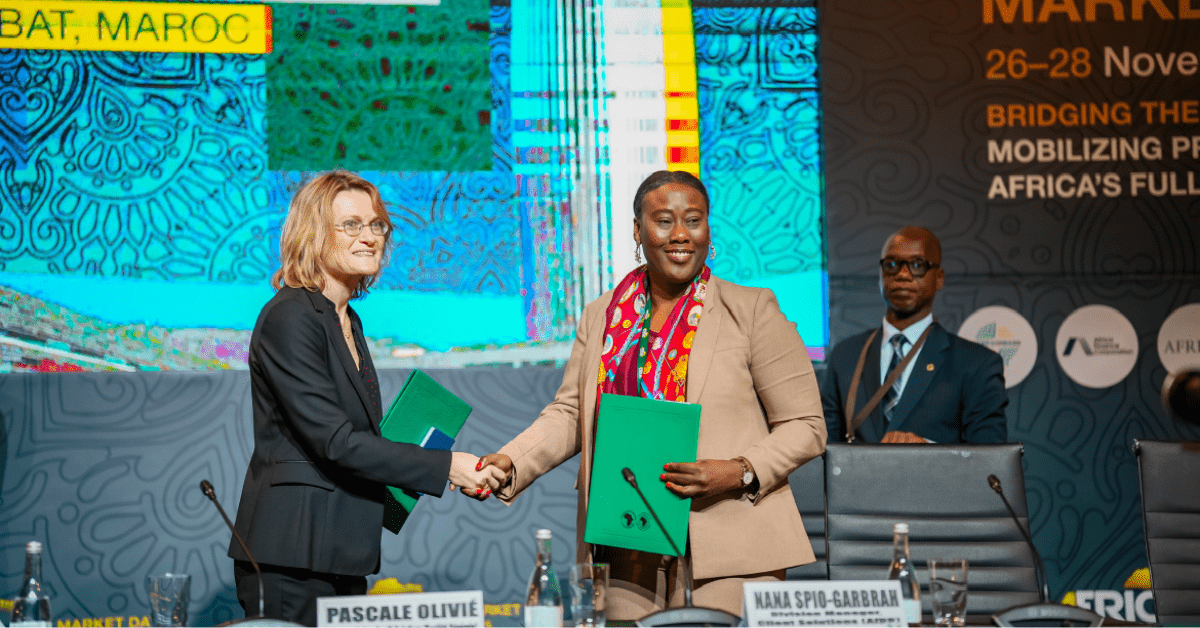

In a move to boost sustainable finance across the continent, the African Development Bank Group (AfDB) has appointed Societe Generale as Lead Advisor for its pioneering Multi-Originator Synthetic Securitization Platform (SST Platform). The agreement was formalized on November 26 during the Africa Investment Forum Market Days 2025 in Rabat.

The SST Platform, part of AfDB’s successful Room to Run (R2R) initiative, is designed as a revolving, evergreen, and scalable risk-transfer vehicle. It aims to provide development finance institutions with regulatory capital relief, strengthen balance sheet resilience, and create pathways for mobilizing private sector investment at scale. Analysts project the platform will expand lending capacity for high-impact projects across Africa, catalyzing investment in sectors critical to the continent’s sustainable growth.

Societe Generale, recognized for its extensive experience in significant risk transfer (SRT) transactions, will lead the design and structuring of the platform, offering advanced financial modeling and investor outreach preparation. The initial phase targets a USD 2 billion reference portfolio encompassing diverse sectors, geographies, and risk profiles. The assets will include contributions from AfDB, the Development Bank of Southern Africa (DBSA), and potentially other African development finance institutions.

Pascale Olivié, Senior Advisor for Asset-Backed Solutions at Societe Generale, commented:

“Societe Generale is proud to leverage its expertise in risk-transfer solutions to support AfDB, DBSA, and other key development institutions in establishing this groundbreaking synthetic securitization platform. This initiative represents a major milestone in advancing sustainable finance and attracting private investment for inclusive growth across Africa.”

Max Ndiaye, AfDB Senior Director for Syndications, Client Solutions, and the Africa Investment Forum, added:

“The SST Platform will act as a catalyst for expanding lending headroom for high-impact projects, reinforcing Africa’s capacity to scale innovative financing solutions that drive sustainable development across the continent.”

The initiative aligns with AfDB’s Ten-Year Strategy and President Sidi Ould Tah’s Four Cardinal Points, which emphasize accelerating private capital mobilization to drive economic growth and development across Africa. By introducing harmonized issuance documentation, standardized credit assessments, and shared Special Purpose Vehicle structures, the SST Platform is positioned to attract broader participation from African and international development finance institutions in the long term.

With this strategic partnership, AfDB and Societe Generale are setting a new benchmark in financial innovation, ensuring that Africa’s high-impact projects receive the private investment needed to transform the continent’s economic landscape.