Africa’s business environment is undergoing a major transformation as governments introduce investor-friendly reforms, digital infrastructure expands, and startup funding continues to rise across the continent.

In 2026, several African countries are emerging as leading destinations for entrepreneurs and foreign investors seeking high-growth markets, stable regulations, and expanding consumer demand.

Based on startup ecosystem strength, ease of doing business, market size, political stability, access to funding, and regulatory environment, these countries stand out as the best places to start a business in Africa in 2026.

Rwanda – Africa’s Ease-of-Business Leader

Rwanda continues to set the benchmark for business registration and regulatory efficiency in Africa. Entrepreneurs see company incorporation completed within days, while digital government services remove much of the traditional bureaucracy that slows startups in emerging markets.

The country’s leadership has prioritised innovation, technology adoption, and transparency, making Kigali an increasingly attractive hub for founders building in fintech, logistics, agribusiness, and clean energy.

For startups seeking a stable and predictable environment, Rwanda remains one of Africa’s most startup-friendly destinations.

Nigeria – Africa’s Largest Market for Startups

Nigeria holds Africa’s biggest consumer market and one of its most dynamic startup ecosystems. Cities like Lagos and Abuja have become magnets for venture capital, fintech innovation, e-commerce growth, and creative businesses.

Despite infrastructure and policy challenges, Nigeria’s scale offers unmatched opportunities. Fintech companies, digital media platforms, logistics startups, and food brands continue to grow at speed, driven by a tech-savvy youth population and rising mobile adoption.

For entrepreneurs targeting rapid growth and regional expansion, Nigeria remains a strategic launchpad.

Kenya – The Silicon Savannah

Kenya has earned its reputation as East Africa’s technology capital. Its strong mobile money infrastructure, supportive innovation hubs, and regional trade links make it ideal for companies building scalable digital products.

Nairobi attracts startups in agritech, health tech, fintech, and SaaS, supported by consistent foreign investment and a mature startup support system.

As East Africa’s gateway economy, Kenya offers founders both stability and access to neighbouring high-growth markets.

South Africa – Africa’s Most Developed Business Ecosystem

South Africa offers Africa’s most advanced financial systems, legal protections, and corporate infrastructure. While operating costs are higher, the country compensates with deep capital markets, strong banking institutions, and experienced talent pools.

Startups in manufacturing, renewable energy, fintech, enterprise software, and professional services continue to thrive, especially those targeting continental or global markets.

For investors seeking structure, strong regulations, and global credibility, South Africa remains a top choice.

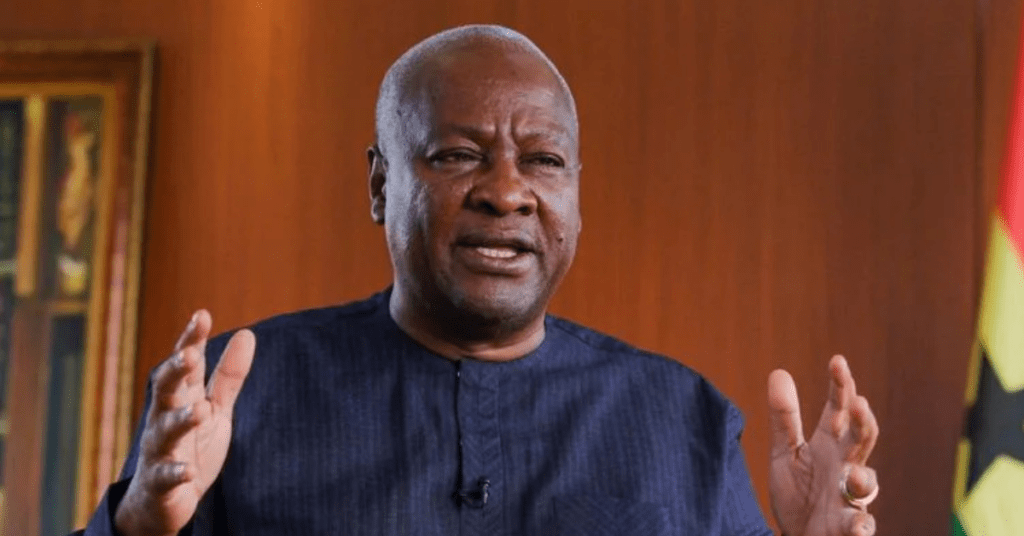

Ghana – West Africa’s Business-Friendly Hub

Ghana has built a reputation for political stability, investor protection, and ease of foreign business ownership. Accra is emerging as a centre for fintech, digital services, manufacturing, and agro-processing.

Government incentives, a growing middle class, and strong diaspora investment flows make Ghana especially attractive to small and medium-scale enterprises entering West Africa.

Egypt – North Africa’s Startup Powerhouse

Egypt combines population scale with strategic geography, connecting Africa, the Middle East, and Europe. Cairo’s startup ecosystem has expanded rapidly, supported by government incentives and rising venture capital activity.

E-commerce, logistics, fintech, and manufacturing companies benefit from access to a large domestic market and export routes into Europe and the Gulf region.

Morocco – Gateway to Europe

Morocco has positioned itself as one of Africa’s strongest manufacturing and export hubs. With trade agreements connecting it to European markets, the country attracts entrepreneurs in automotive production, technology outsourcing, and industrial services.

Stable governance and strong infrastructure continue to boost investor confidence.

Mauritius – Africa’s Business and Tax Haven

Mauritius stands out for its low taxes, strong legal system, and efficient financial services. Many African startups register holding companies there to attract international investors and structure cross-border operations.

It remains ideal for fintech firms, investment vehicles, and regional headquarters.

Botswana – Stability and Transparency

Botswana offers political stability, low corruption levels, and consistent economic policies. Although smaller in market size, it presents strong opportunities in mining services, tourism, fintech, and infrastructure support businesses.

Senegal – Francophone West Africa’s Rising Star

Senegal is fast becoming a business gateway for Francophone Africa. Dakar’s infrastructure development, pro-business reforms, and strategic Atlantic location attract logistics firms, agribusinesses, and digital service startups.

Why Africa in 2026?

Africa’s startup ecosystem is projected to continue its upward trajectory through:

• Increased venture capital funding

• Expansion of AfCFTA trade benefits

• Growth of digital payments and mobile commerce

• Rising youth entrepreneurship

• Infrastructure investment across energy and logistics

For founders willing to understand local markets and adapt quickly, Africa offers some of the world’s most promising business opportunities.

Conclusion

From Rwanda’s efficiency to Nigeria’s market scale and Kenya’s innovation ecosystem, Africa presents diverse pathways to success in 2026. The key lies in matching business models with the right regulatory environment, customer base, and growth strategy.

For entrepreneurs, investors, and global partners, the continent is no longer just an emerging market, it is becoming one of the world’s most competitive startup frontiers.