The African Export-Import Bank (Afreximbank) has strengthened Angola’s energy sector with a $1.75 billion syndicated receivables purchase facility for Sonangol, the country’s national oil company.

The financing will support Sonangol’s operating and capital expenditure needs at a time when Angola seeks to stabilise production, grow exports, and attract long-term investment into its oil and gas industry.

At the same time, the transaction advances Afreximbank’s strategy of promoting African-led financing models that drive industrialisation, economic self-reliance, and trade resilience across the continent.

Working with other mandated lead arrangers, Afreximbank structured and syndicated the facility using its balance sheet to unlock large-scale funding while reducing risk for lenders. The structure also mitigates oil price volatility and allows flexible security arrangements, which improves access to capital for the Angolan energy sector.

The $1.75 billion facility is expected to strengthen export-linked trade structures and support Afreximbank’s objective of increasing Africa’s share of global trade, particularly in strategic commodities such as crude oil and refined petroleum products.

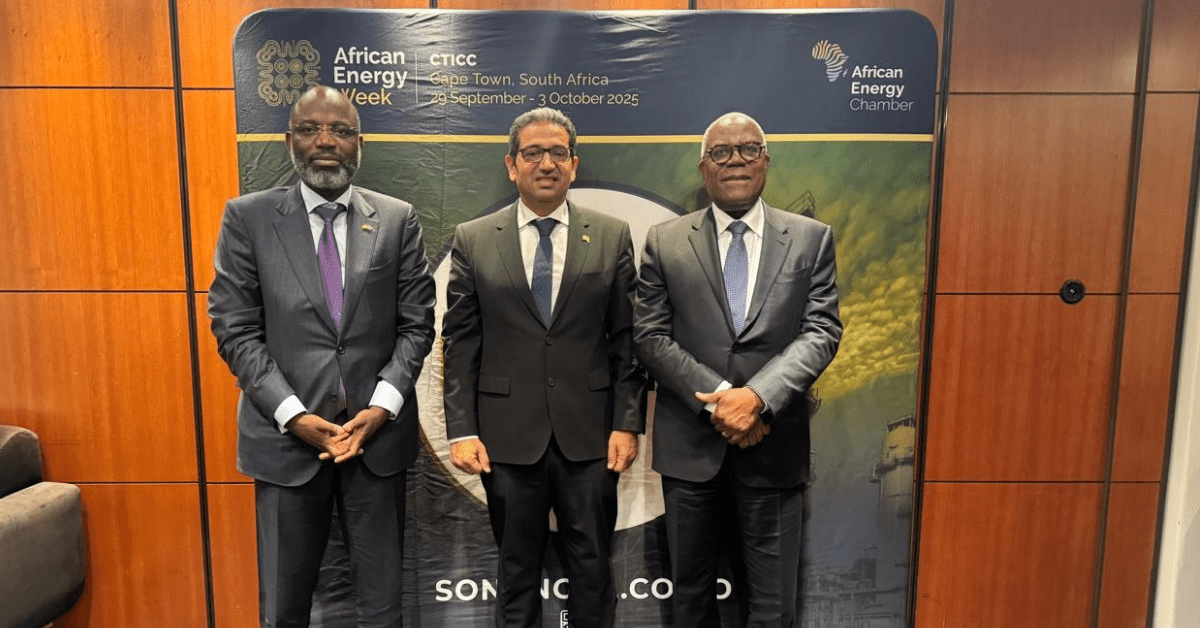

Commenting on the transaction, Haytham Elmaayergi, Executive Vice President of Global Trade Bank at Afreximbank, said the deal reflects the institution’s long-term commitment to African energy champions.

“This $1.75 billion syndicated receivables facility underscores Afreximbank’s commitment to supporting African energy champions and safeguarding export capacity that is critical to our member states’ macroeconomic sovereignty and trade resilience,” he said.

He added that innovative financing structures now allow the bank to mobilise capital into key sectors while easing traditional security requirements for borrowers.

“The transaction will help Sonangol meet its operating and capital needs, sustain export flows, increase energy availability, and support Angola’s broader industrialisation and economic transformation, while directly contributing to increased African participation in global trade,” Elmaayergi said.

Analysts say the facility could play a significant role in strengthening Angola’s economic outlook by enabling continued extraction and commercialisation of natural resources, boosting export revenues, and reinforcing value creation across the wider economy.

For Sonangol, the funding provides financial stability to maintain operations and pursue new investments. For Afreximbank, it reinforces its position as a leading driver of large-scale trade finance and energy investment in Africa.

For Angola, it marks another step toward converting natural resources into sustainable economic growth and deeper integration into global energy markets.