The United States has launched a renewed Africa strategy centered on investment, infrastructure, and private capital as competition for economic and geopolitical influence across the continent intensifies.

Rather than relying on traditional aid, Washington is now prioritising trade integration, infrastructure finance, and private sector participation. This shift reflects a broader effort to remain relevant in Africa’s fast-changing strategic landscape.

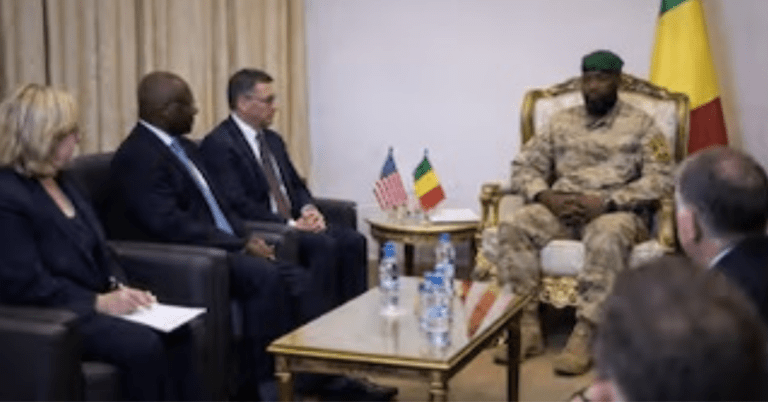

At the centre of this recalibration is the newly established Strategic Infrastructure and Investment Working Group, created in partnership with the African Union (AU). US Deputy Secretary of State Christopher Landau and African Union Commission Chairperson Mahmoud Ali Youssouf agreed on the framework during high-level talks in Addis Ababa.

Importantly, both sides acknowledged that long-term influence in Africa will increasingly depend on who delivers growth-enabling infrastructure and sustainable economic opportunities.

Aligning With Africa’s Development Agenda

According to a joint statement, the working group will align closely with Africa’s core development priorities. These include Agenda 2063, the Programme for Infrastructure Development in Africa (PIDA), and the African Continental Free Trade Area (AfCFTA).

Moreover, the framework will act as a coordination platform linking senior policymakers and technical experts. Its primary mandate involves identifying bankable projects and mobilising US private sector investment across critical sectors.

These sectors include transport corridors, energy systems, digital infrastructure, and regulatory harmonisation. Notably, these areas have become focal points for global competition as external powers race for partnerships and market access.

Infrastructure at the Centre of Strategic Competition

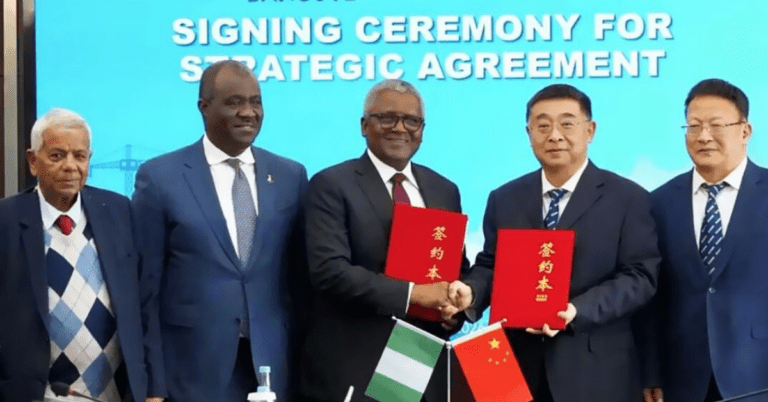

Washington’s approach reflects a growing recognition that Africa’s infrastructure gap represents both an economic challenge and a strategic battleground. Rival powers have expanded their footprint through aggressive financing, construction projects, and technology partnerships.

Meanwhile, the AfCFTA continues to face constraints from weak logistics networks, fragmented regulations, and limited cross-border connectivity. Without major infrastructure upgrades, the world’s largest free trade area risks falling short of its full potential.

By channeling private capital into transport, energy, and digital trade infrastructure, the working group could help reduce trade costs and accelerate continental integration.

From Aid to Profitable Partnerships

Crucially, the emphasis on “durable, profitable investments” signals a clear break from donor-driven engagement models. Instead, the US is betting on long-term commercial partnerships aligned with African-led priorities.

For African governments, the initiative offers a pathway to unlock private capital while advancing continental development goals. At the same time, it supports job creation, trade expansion, and technology transfer.

For Washington, the strategy represents a calculated return to Africa through investment-led engagement. Ultimately, US officials believe shared prosperity, trade integration, and infrastructure delivery, not aid dependency will define the next chapter of US–Africa relations.