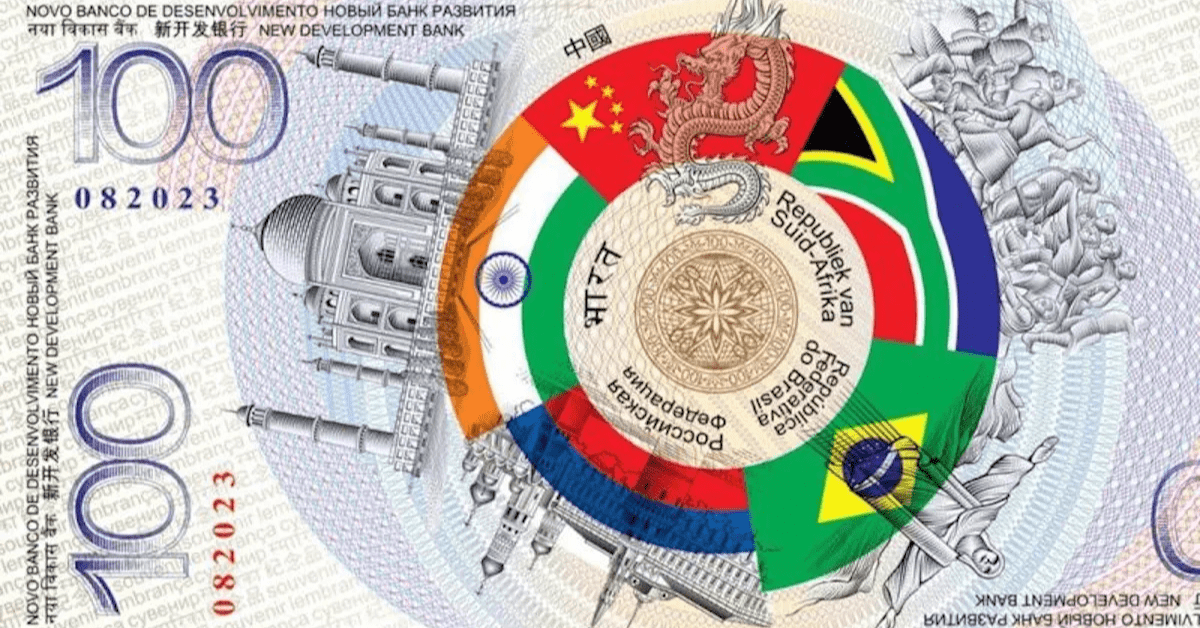

As India prepares to host the BRICS summit later this year, the bloc is quietly advancing plans for a new global payment system built around national digital currencies, a move that could reshape cross-border trade without launching a single BRICS currency.

Rather than reviving the politically sensitive idea of a shared currency, BRICS leaders are focusing on infrastructure that allows national digital currencies to interact directly. The initiative centres on creating a payment rail that links central bank digital currencies, or CBDCs, enabling trade to settle in local currencies instead of moving through the dollar-based SWIFT system.

This approach has attracted less public attention because it avoids overt challenges to the US dollar. However, analysts say it may prove far more consequential. By changing how payments move rather than what currency is used, BRICS is betting that practical systems can alter global finance more effectively than symbolic gestures.

The proposal does not involve creating a BRICS currency or transferring monetary authority to a supranational institution. Each member would retain full control over its currency. Instead, the system would connect existing CBDCs such as India’s digital rupee, China’s digital yuan and Russia’s digital ruble through interoperable infrastructure.

In practice, the system would allow cross-border transactions to settle directly between national currencies without passing through correspondent banks. As a result, payments would move faster, transaction costs would fall, and exposure to sanctions or asset freezes would decline.

India has emerged as a central driver of the initiative. As summit host, New Delhi has pushed CBDC interoperability from an abstract concept into policy coordination. The move reflects India’s domestic payments philosophy shaped by the success of its Unified Payments Interface, which prioritises interoperability while preserving monetary sovereignty.

The Reserve Bank of India has repeatedly stressed that the digital rupee is neither a cryptocurrency nor a step toward a currency union. It functions as a state-backed digital equivalent of cash designed to improve efficiency while retaining policy control. This position explains why India has resisted proposals for a single BRICS currency while supporting infrastructure that strengthens the use of national currencies in trade.

Past experience has also influenced India’s stance. Earlier bilateral settlement arrangements with Russia left Moscow holding large rupee balances that were difficult to spend, a problem known as the “rupee trap”. That outcome highlighted the limits of bilateral deals and reinforced the need for a multilateral network in which currencies can circulate across a wider trading bloc.

At the core of the proposed system are settlement cycles and foreign exchange swap lines. Settlement cycles allow payments between countries to be netted over a set period, reducing the amount of currency that must move at any one time. Only the net balance is settled, cutting costs and preventing the accumulation of unusable currency surpluses.

Meanwhile, swap lines act as a liquidity backstop. Central banks can temporarily exchange currencies if one side faces a short-term shortage, ensuring that settlement obligations are met without market disruption. Together, these mechanisms make trade in national currencies viable without reliance on the dollar.

Despite these efforts, the US dollar remains dominant in global finance. It accounts for roughly 59% of global foreign exchange reserves and underpins most international payments. At the same time, rising US and global dollar-denominated debt has become a growing source of systemic risk.

US national debt is approaching $39 trillion, while global debt is estimated at about $315 trillion, with nearly two-thirds denominated in dollars. Servicing this debt depends on continued global demand for dollar assets. If that demand weakens, interest rates could rise sharply, increasing US debt servicing costs and tightening global financial conditions.

To protect the dollar’s role, the United States relies on a combination of sanctions, institutional influence and financial regulation. Control over access to SWIFT and the dollar payment system remains a powerful deterrent, as seen in the economic isolation faced by countries such as Iran and Russia.

At the same time, Washington is working to extend the dollar’s reach into digital finance by shaping the regulatory framework for dollar-backed stablecoins. The strategy aims to ensure that financial innovation reinforces rather than undermines dollar dominance.

However, recent trends suggest growing unease. In 2025, foreign central banks’ gold holdings surpassed their holdings of US Treasuries in value for the first time in nearly three decades. Gold prices surged beyond $4,000 per ounce and continued rising in early 2026, reflecting a gradual shift toward neutral assets with no counterparty risk.

Concerns about asset freezes have also accelerated BRICS efforts. The confiscation of $300 billion in Russian reserves marked a turning point, reinforcing fears that no country is immune from similar actions. That episode strengthened the case for alternative payment channels that can function during periods of geopolitical tension.

While a fully operational BRICS payment system remains some distance away, momentum is building. Most BRICS CBDCs are still in testing phases, and legal and technical hurdles remain. Yet rising geopolitical uncertainty and unpredictable policy shifts have made alternative payment infrastructure increasingly urgent.

Development is expected to proceed pragmatically. Existing bilateral links, such as the interoperability between India’s UPI and the UAE’s instant payment platform, provide a tested model. Over time, similar connections could integrate systems such as Brazil’s PIX and China’s digital yuan infrastructure.

Initially, the network would reduce reliance on SWIFT through bilateral arrangements. Eventually, a shared platform could emerge, allowing voluntary participation while respecting national differences. Despite the challenges, the direction is clear.

The global financial system is unlikely to shift overnight. Still, by laying parallel payment rails, BRICS aims to ensure that trade continues even in times of crisis. With India setting the pace, the bloc is taking its first concrete steps toward a more multipolar financial order.