Ethiopia has taken a major step toward reshaping its position in Africa’s mining landscape after securing $340 million in financing to develop the Tulu Kapi gold project, widely regarded as the country’s largest modern gold mining venture to date.

The long-awaited project has reached a critical milestone following the completion of its development financing package, unlocking the path to full-scale construction. The funding comprises approximately $240 million in long-term debt provided by African development finance institutions, alongside about $100 million in equity contributions, giving project developer KEFI Gold and Copper the financial backing required to move the mine into its construction phase.

KEFI’s Executive Chairman, Harry Anagnostaras-Adams, confirmed that all parties have now signed the debt arrangements, marking what he described as a defining moment for the project. He noted that the agreement has already triggered renewed activity on site, while final equity commitments are being concluded with a mix of local and specialist investors. According to him, the project’s launch aligns with favourable global market conditions, as gold prices remain at record highs.

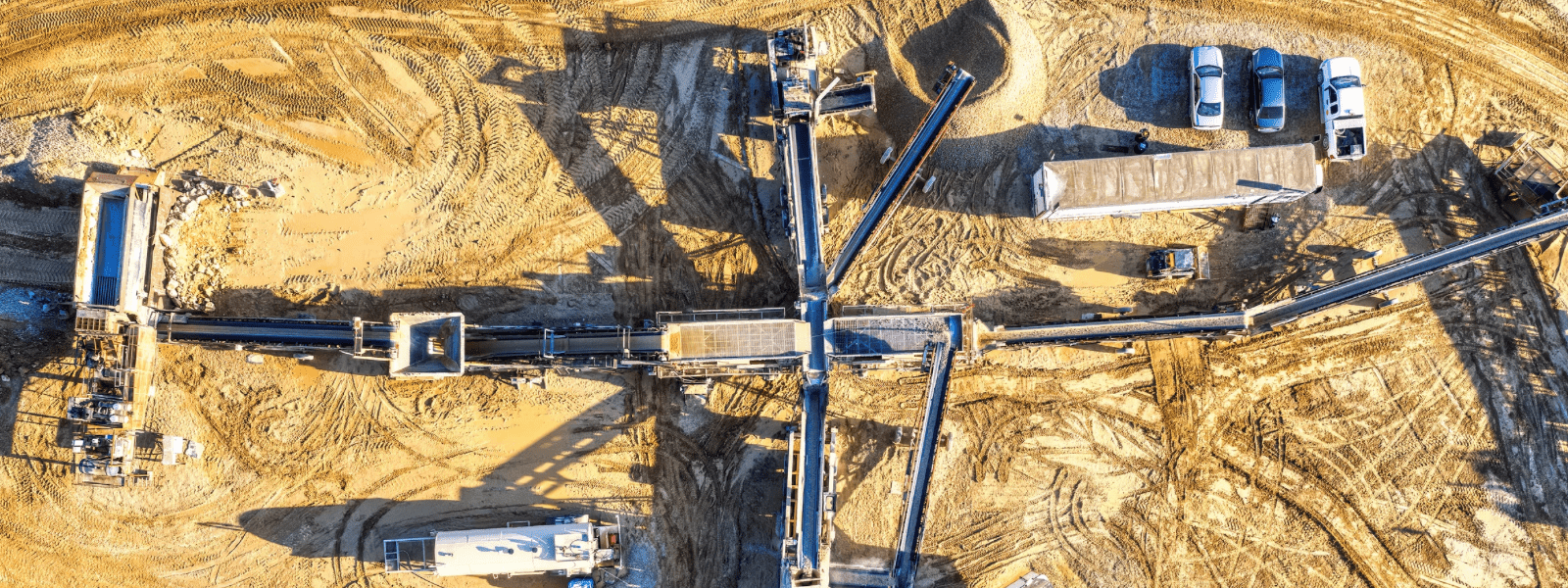

Early-stage works are already underway at the Tulu Kapi site, including the development of housing facilities, power infrastructure, and road access, as preparations intensify for the mine’s full build-out. The project is located roughly 360 kilometres west of Addis Ababa and is expected to begin commercial production in 2027.

Once operational, Tulu Kapi is projected to produce an average of about 164,000 ounces of gold annually over its first seven years, positioning it as one of Ethiopia’s most significant gold operations. The mine is expected to play a vital role in boosting foreign exchange inflows, job creation, and infrastructure development at a time when the country is seeking new sources of hard currency.

The project is being developed in partnership with the Ethiopian government, which holds a carried interest and has committed to an equity stake. This reflects Addis Ababa’s broader strategy to elevate mining as a key pillar of economic growth and export diversification. In recent years, Ethiopia has intensified efforts to modernise its mining sector following decades of underinvestment, with gold increasingly contributing to national export revenues.

Designed initially as an open-pit operation with potential for underground expansion, Tulu Kapi offers the possibility of extending production beyond its initial mine life. Ethiopian officials and industry stakeholders view the project as a flagship investment capable of unlocking further foreign interest in the country’s largely untapped mineral resources.

The timing of the project also mirrors a wider continental shift. Across Africa, governments are moving to extract greater value from natural resources, particularly gold, as countries respond to currency pressures, fiscal constraints, and global economic uncertainty. Nations including Ghana, Sudan, and several Sahel states have expanded state participation in mining as part of efforts to stabilise public finances.

For Ethiopia, the advancement of the Tulu Kapi gold mine represents a potential turning point. With financing largely secured and construction imminent, the project stands as a test case for how mineral wealth can be converted into sustainable economic gains, reinforcing the country’s ambition to emerge as Africa’s next gold powerhouse.