The all-stock acquisition, valued between $25 million and $40 million, positions Flutterwave to dominate payments and financial data infrastructure across Africa.

Africa’s fintech landscape took a historic turn as Flutterwave, the continent’s largest payments company, announced the acquisition of Nigerian open banking startup Mono. Sources familiar with the deal estimate the transaction is worth between $25 million and $40 million, marking one of the rare high-profile exits in African fintech.

The acquisition unites two of Africa’s leading fintech infrastructure companies. Flutterwave operates an expansive payments network across more than 30 African countries, while Mono, often dubbed the “Plaid for Africa,” provides APIs that allow businesses to access bank data, verify customers, and initiate payments. Together, the companies now offer an integrated suite of services that spans payments, onboarding, identity verification, and data-driven risk assessment.

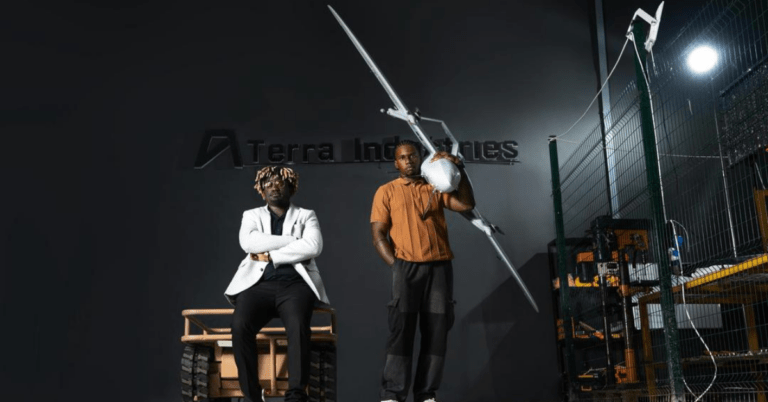

Founded in 2020, Mono addresses a critical gap in African finance. With limited credit bureau coverage, lenders often rely on customers’ bank transactions to assess creditworthiness. Mono’s API infrastructure enables businesses to securely access financial data, giving lenders insights into income, spending patterns, and repayment capacity. According to CEO Abdulhamid Hassan, Mono has facilitated more than 8 million bank account linkages, covering roughly 12% of Nigeria’s banked population. The company has also delivered 100 billion financial data points to lending platforms, including Visa-backed Moniepoint and GIC-backed PalmPay.

For investors, the deal represents a solid return. Mono had previously raised approximately $17.5 million from backers like Tiger Global, General Catalyst, and Target Global. Industry insiders suggest some early investors could see paper returns of up to 20x through the all-stock arrangement with Flutterwave. Despite the acquisition, Mono will continue to operate as an independent product, maintaining its brand and services.

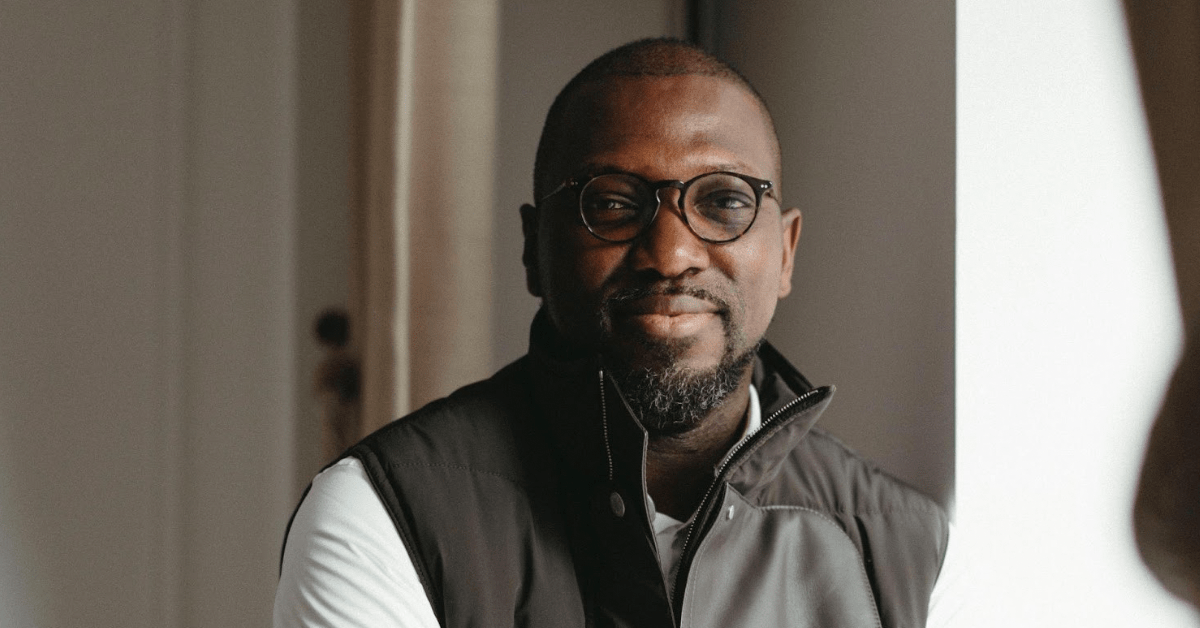

Flutterwave CEO Olugbenga “GB” Agboola described the acquisition as a strategic bet on Africa’s next phase of fintech growth. “Payments, data, and trust cannot exist in silos,” he said. “Open banking provides the connective tissue, and Mono has built critical infrastructure in this space.” Hassan echoed this vision, highlighting Africa’s shift toward credit-driven financial inclusion. He emphasized the importance of robust data infrastructure and regulatory confidence, especially in markets like Nigeria where open banking frameworks are still developing.

The deal also accelerates Flutterwave’s vertical integration. Beyond traditional payments, the company can now offer onboarding, bank account verification, and recurring payment solutions in a single ecosystem. Hassan noted that joining Flutterwave positions Mono to scale rapidly across Africa once regulatory barriers ease.

Historically, global fintech has seen similar consolidation attempts, such as Visa’s proposed acquisition of Plaid in 2020, which U.S. regulators blocked. Hassan pointed to that deal as evidence of the growth potential unlocked by combining data infrastructure with payment networks. Both Mono and Flutterwave share investors, including Tiger Global, though the firm did not facilitate the transaction. Instead, the acquisition stems from years of partnership and collaboration on bank payment products.

Mono’s journey reflects the evolution of African open banking. Competing with Okra and Stitch at launch, Mono emerged as a leading player after Okra shut down and Stitch pivoted toward broader payments solutions. Hassan emphasized that Mono was not under pressure to sell. With strong cash reserves and a path toward profitability this year, raising additional funding could have introduced unwanted valuation pressures in the current financing climate.

Industry analysts suggest the Flutterwave-Mono deal signals a broader trend. African fintechs, once aiming to scale independently, may increasingly find better outcomes by integrating with larger platforms. Similar moves, such as South African fintech consolidation between Lesaka and Adumo, indicate a maturing market where scale, compliance, and data infrastructure are key competitive advantages.