Nigeria’s fintech star, PiggyVest, achieved record-breaking payouts in 2025, disbursing ₦1.3 trillion to users and solidifying its role as a leading digital savings and investment platform in Africa’s largest economy.

The payout represents a 56% increase from the ₦835 billion distributed in 2024. This surge comes as PiggyVest approaches its 10th anniversary and celebrates crossing six million registered users, signaling strong trust in a highly competitive fintech market.

In a year marked by rapid growth, PiggyVest revealed that its assets under management surged by 110% in 2025. The company also completed a major operational shift, launching its in-house payment system powered by PocketApp while retiring the virtual account numbers used since inception.

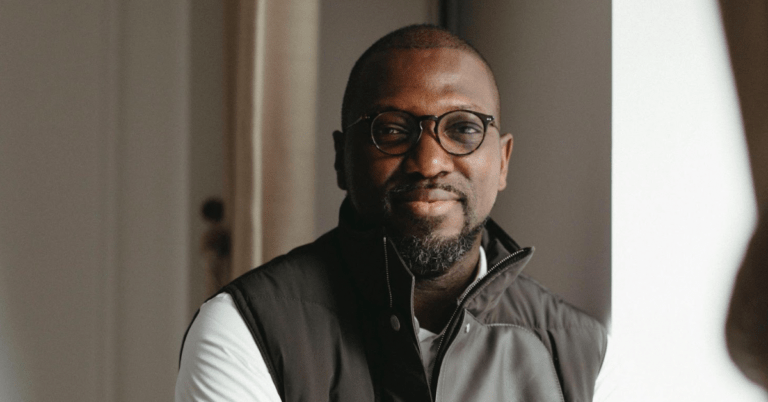

Co-founder and Chief Marketing Officer, Joshua Chibueze, explained that controlling its payment infrastructure enhances reliability and gives PiggyVest better control over deposits and payouts—critical factors in Nigeria’s fast-paced digital financial market.

PiggyVest’s achievements in 2025 also earned international recognition. The platform featured on CNBC’s list of top fintech companies alongside Interswitch, Moniepoint, and M-KOPA, highlighting its growing global footprint.

Since its launch in 2016, PiggyVest has paid out over ₦3 trillion to users. Initially a personal savings app, it has evolved into a full-fledged financial platform. While individual savings remain central, the company has expanded its offerings to serve businesses through PiggyVest Business. Products like Investify and Safelock now allow small businesses to access low-risk investments and interest-bearing accounts. Early adoption, according to the company, has been promising.

Community engagement has also driven PiggyVest’s growth. In 2025, the fintech expanded its OpenHouse programme, hosting town halls in Lagos, Abuja, and three other cities. Chibueze stated that these events provided valuable feedback that influenced product strategy and improved user experience.

Looking ahead, PiggyVest plans to launch PiggyVest Kids, a savings product designed for children. The rollout is expected around Children’s Day this year, reflecting the company’s commitment to building long-term financial habits across generations.

Chibueze described the ₦1.3 trillion payout as a reflection of growing user confidence. He emphasized that PiggyVest’s consistent focus on transparency, reliability, and measurable impact has helped restore trust in digital savings and investments in Nigeria.

As the Nigerian fintech sector continues to evolve, PiggyVest’s 2025 performance demonstrates the power of local innovation, infrastructure ownership, and community-driven growth. Its trajectory underscores how homegrown fintech solutions can achieve scale, resilience, and lasting financial impact across Africa.