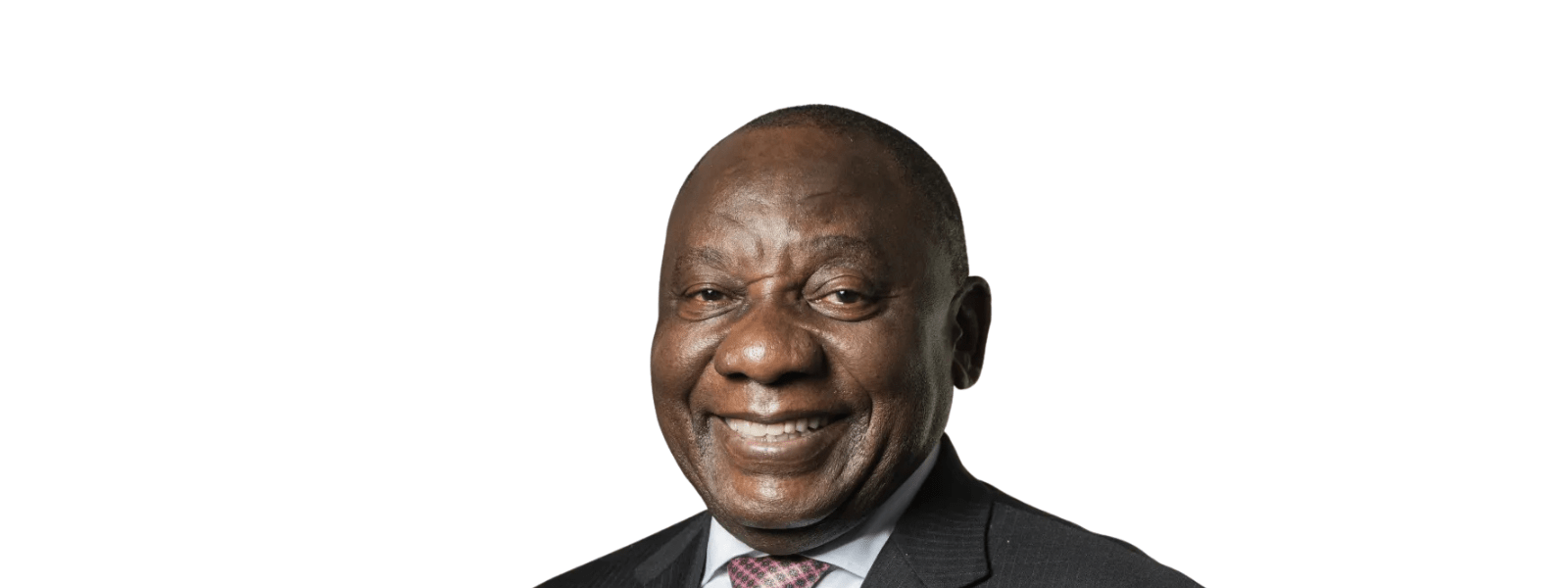

Before his return to frontline politics, President Cyril Ramaphosa played a pivotal but often understated role in one of South Africa’s most transformative technology moments, the disruption of Telkom’s long-standing monopoly over international fibre connectivity.

In the late 2000s, as South Africa’s broadband market struggled under high data costs and limited access, the arrival of the Seacom undersea cable promised a seismic shift. Seacom’s planned entry threatened to dismantle Telkom’s dominance in international bandwidth and unlock faster, cheaper internet for businesses and consumers alike. However, the project nearly stalled amid intense political and regulatory resistance.

In September 2007, just as Seacom was preparing to commence construction, the South African government announced that no undersea cable would be permitted to land in the country unless it was majority-owned by local or African investors. The declaration, made by the late former communications minister Ivy Matsepe-Casaburri, drew swift backlash from industry stakeholders, who argued that the immense capital required to build submarine cables made such ownership conditions unrealistic.

At the time, most international cables were backed by global telecom consortia, making Seacom a privately funded project, a rare exception. As a workaround, Seacom proposed landing its cable in international waters and connecting to South Africa via infrastructure owned by Neotel, Telkom’s newly launched competitor. The move, structured through a sale-and-leaseback arrangement, allowed construction to proceed while technically navigating the last-minute ownership demands.

Despite these efforts, the workaround failed to appease government officials, intensifying speculation that the resistance was aimed at protecting Telkom’s lucrative monopoly. Industry insiders later suggested that competing political and commercial interests, including another AU-backed submarine cable project linked to NEPAD, may also have influenced the opposition.

Undeterred, Seacom pushed forward, securing critical backing from influential South African investors. Among them were Andile Ngcaba’s Convergence Partners, Johann Rupert’s Venfin, and Cyril Ramaphosa’s Shanduka Group. With the support of Ramaphosa and Ngcaba, Seacom complied with every regulatory hurdle placed in its path.

By the time the cable went live, Seacom had achieved 52% African ownership, including 25% South African shareholding and 27% held by East African investors, a milestone that satisfied regulatory requirements and underscored its Pan-African positioning.

The impact was immediate and profound. Within two months of Seacom landing in KwaZulu-Natal, Afrihost introduced an ADSL package priced at R29 per gigabyte, slashing international data costs by more than 50%. Afrihost CEO Gian Visser noted that such aggressive pricing would have been impossible without Seacom’s entry into the market.

Six months later, Mweb raised the stakes further by launching an affordable uncapped ADSL service from R219 per month, marking a turning point in South Africa’s broadband evolution. Former Mweb CEO Rudi Jansen credited Seacom as a key enabler, describing the cable operator as a forward-thinking partner that recognised the long-term value of early, high-volume bandwidth sales.

Seacom’s arrival effectively ended Telkom’s stranglehold on international subsea fibre capacity and opened the floodgates for competitive, consumer-friendly broadband offerings. Reflecting on the moment, Ramaphosa described the cable as a digital highway capable of unlocking Africa’s potential.

“We needed to increase the bandwidth through which people could communicate faster and cheaper,” he said at the time. “Seacom has provided a highway along which people can travel. The world will be surprised by how Africans will explode on this new highway and begin to do things that will astound the world.”

Ramaphosa officially stepped away from the Shanduka Group on 26 May 2014 following his appointment as Deputy President of South Africa. His family’s interests were placed in blind trusts as regulatory approvals were secured for the merger between Shanduka and Phutuma Nhleko’s Pembani Group. The transaction, approved in August 2015, marked his complete exit from the BEE investment firm.

Today, as President of South Africa, Ramaphosa’s legacy in reshaping the country’s digital landscape remains a defining chapter that illustrates how strategic investment, resilience, and vision helped lay the foundation for a more connected and competitive African economy.